Western Wealth Capital’s sale of Anzio nets 33% annualized return

August 30, 2017

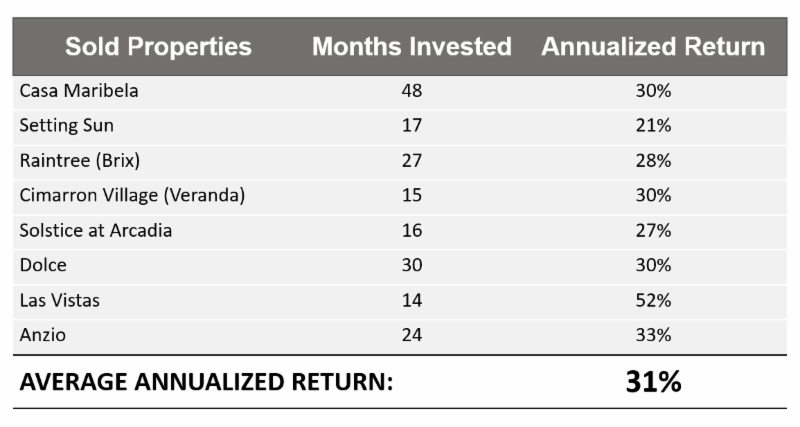

Average Annualized Return of Divested Properties to Date: 31%

Western Wealth Capital (WWC), a growth-oriented real estate investment company, is pleased to announce the completion of its sale of Anzio, a multifamily unit building in the company’s Arizona portfolio.

WWC purchased the 240-unit multifamily building in August 2015 for $19.5 million (all figures $US). WWC has now sold the multi-family community for $25.7 million – a 32% increase to acquisition price. Net of capital investments on building improvements, WWC investors in Anzio received an annualized return of 33%.

Janet LePage, Chief Executive Officer of WWC, says the company’s consistent performance is the result of both an adherence to a precise business strategy and Phoenix’s strong economic fundamentals.

“We remain strongly bullish on Phoenix and the investment opportunities available. Our deal flow that meets our criteria remains very active,” says LePage.

Year to date, WWC has made four accretive divestments and six acquisitions. WWC is currently in the purchase process for Marble Creek, a 244-unit apartment community located five miles from the I-17 corridor and the second largest employment hub in Phoenix’s Southwest Valley.

WWC’s investment strategy typically has a three-to-five year horizon. WWC divests either when it is accretive at the end of the time horizon, or we receive an offer that exceeds our business plan targets.

WWC has a disciplined six-stage strategy. We acquire undervalued multi-family rental properties; carefully allocate capital to accretive improvements; optimize operations to increase the asset’s net cash flow and valuation; refinance to return equity to investors; and, when appropriate, divest.

Since its inception in 2011, WWC has acquired 31 multi-family unit buildings, representing 5,125 units, with a combined purchase-value of more than $375 million. Our current portfolio, net of divestments, includes 23 multi-family unit rental buildings (nearly 4,300 units) in the Greater Phoenix area. WWC is now the second largest multi-family owner in the Phoenix area by number of units.

About Western Wealth Capital

We have a singular focus: create wealth through well-selected real estate investment. We acquire under-performing multifamily rental properties and increase net operating income and valuation through an approach that has been successfully applied across our entire portfolio. We manage these assets, distribute resulting cash flow to investors and, when appropriate, divest. We only focus on markets underpinned by the economic fundamentals of population, employment and GDP growth. Our entry point is when these demand drivers place long-term pressure on vacancy rates and rental pricing. To date, we have invested in the Phoenix and San Antonio markets. Our execution and results have formed strong relationships that give us access to some of the best multifamily investment opportunities in the American Southwest.

Media and photo requests:

Glen Edwards

gedwards@national.ca

For more information:

604.260.4789

info@westernwealthcapital.com

www.westernwealthcapital.com

No securities commission or similar regulatory authority has reviewed this content. In considering the prior performance information contained herein, prospective investors should bear in mind that past performance is not necessarily indicative of future results, and there can be no assurance that Western Wealth Capital will achieve comparable results. This press release includes forward-looking statements. All statements other than statements of historical facts included in this document, including, without limitation, statements regarding the future financial position, targeted or projected investment returns and business strategy are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “forecasted,” “projected,” “estimate,” “anticipate,” “believe,” or “continue” or the negative usages thereof or variations thereon or similar terms. Forward-looking statements reflect our current expectations and assumptions as of the date of the statements, and are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Although we believe that the assumptions on which the forward-looking statements are made are reasonable, based on the information available to it on the date such statements were made, no assurances can be given as to whether these assumptions will prove to be correct. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements contained are expressly qualified in their entirety by this cautionary statement. No representation or warranty is made to the accuracy or completeness of any of the information contained herein.