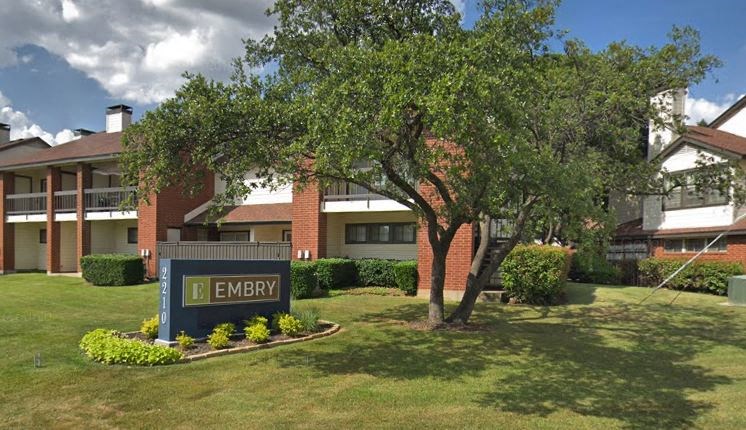

Western Wealth Capital Acquires Embry Apartment Homes in Carrollton, Texas

July 14, 2022

Growth-oriented multifamily real estate investment company acquires twenty-fifth property in Carrollton, Texas, part of the growing Dallas Fort-Worth Metroplex

North Vancouver, Canada (July 14th, 2022) – Western Wealth Capital (WWC) announces the closing of its 130th real estate acquisition – Embry Apartment Homes in Carrollton, Texas. This is Western Wealth Capital’s 21st multifamily acquisition in the Dallas-Fort Worth market.

WWC and its investment partners closed on the 151-unit multifamily apartment community of Embry Apartment Homes. Built in 1985, with additional units added in 1995, the property offers multiple value-add opportunities to increase revenue. This Dallas-area deal further solidifies WWC’s footprint in the U.S. multifamily housing market and follows WWC’s disciplined investment criteria.

Located in the northern area of the Dallas-Fort Worth metroplex in Carrollton, Texas, Embry is conveniently positioned 6-minutes from the Dallas North Tollway, linking to downtown Dallas in 28-minutes. Notably, Embry is located 14-minutes from Legacy West, a 240-acre mixed-use project with major employers including FedEx Office, Toyota Motor North America, Liberty Mutual Insurance, and JPMorgan Chase.

“Embry presents a highly sought-after investment opportunity for Western Wealth Capital’s interior and exterior value-add programs,” says Jay O’Connor, Senior Director of Acquisitions at WWC. “There is significant value-add potential for upgrading interiors, and opportunity exists for the installation of washer/dryers which have previously proven successful in securing additional rental premiums. We look forward to beginning immediate property improvements to provide upgraded housing options for Embry’s residents and positive returns for investors.”

“We are very pleased to have acquired this property in a market that is showing strong population growth. We look forward to beginning immediate property improvements and executing our business plan for Villetta,” says Doug Mather, WWC’s Executive Vice President.

About Western Wealth Capital

WWC has developed a proven system for investing in multifamily properties in key real estate markets across the U.S. WWC offers investment partners the opportunity to invest in properties with substantial value-add opportunities. Since its inception, WWC has successfully completed more than $5.3 billion in real estate transactions, acquiring 130 multifamily assets representing more than 29,000 total units.

WWC’s vision is to build wealth for its investment partners with exceptional returns. A people-first approach promotes excellence at every point; with highly efficient operations and a true commitment to our communities. The company’s current portfolio of assets under management includes 59 multifamily rental buildings, totaling more than 15,000 units.

Contact Us

Media and photo requests:

Alex Collins

alex@westernwealthcapital.com

For more information:

604.260.4789

info@westernwealthcapital.com

www.westernwealthcapital.com

No securities commission or similar regulatory authority has reviewed this content. In considering the prior performance information contained herein, prospective investors should bear in mind that past performance is not necessarily indicative of future results, and there can be no assurance that Western Wealth Capital will achieve comparable results. This press release includes forward-looking statements. All statements other than statements of historical facts included in this document, including, without limitation, statements regarding the future financial position, targeted or projected investment returns and business strategy are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “forecasted,” “projected,” “estimate,” “anticipate,” “believe,” or “continue” or the negative usages thereof or variations thereon or similar terms. Forward-looking statements reflect our current expectations and assumptions as of the date of the statements, and are subject to a number of known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause actual results, performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Although we believe that the assumptions on which the forward-looking statements are made are reasonable, based on the information available to it on the date such statements were made, no assurances can be given as to whether these assumptions will prove to be correct. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements contained are expressly qualified in their entirety by this cautionary statement. No representation or warranty is made to the accuracy or completeness of any of the information contained herein.